Americans are feeling somewhat more hopeful about the pandemic and travel, but the recent surge has diminished some potential trip volume that may have occurred. An approved vaccine continues to be very promising in bringing a segment of travelers back and increasing travel overall. In the meanwhile, most still want to see people masked in travel ads.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. Every week since March 15th, Destination Analysts has surveyed 1,200+ American travelers about their thoughts, feelings, perceptions and behaviors surrounding travel in the wake of the coronavirus pandemic and explored a variety of topics. The findings presented below represent data collected November 6th-November 8th.

Key Findings to Know:

- While Americans overwhelmingly remain in an elevated state of anxiety, fewer feel the coronavirus situation is going to get worse in the next month, the perceptions of travel activities as safe rebounded, and excitement for a potential getaway, openness to travel inspiration and the ability of discounts to motivate travel all improved.

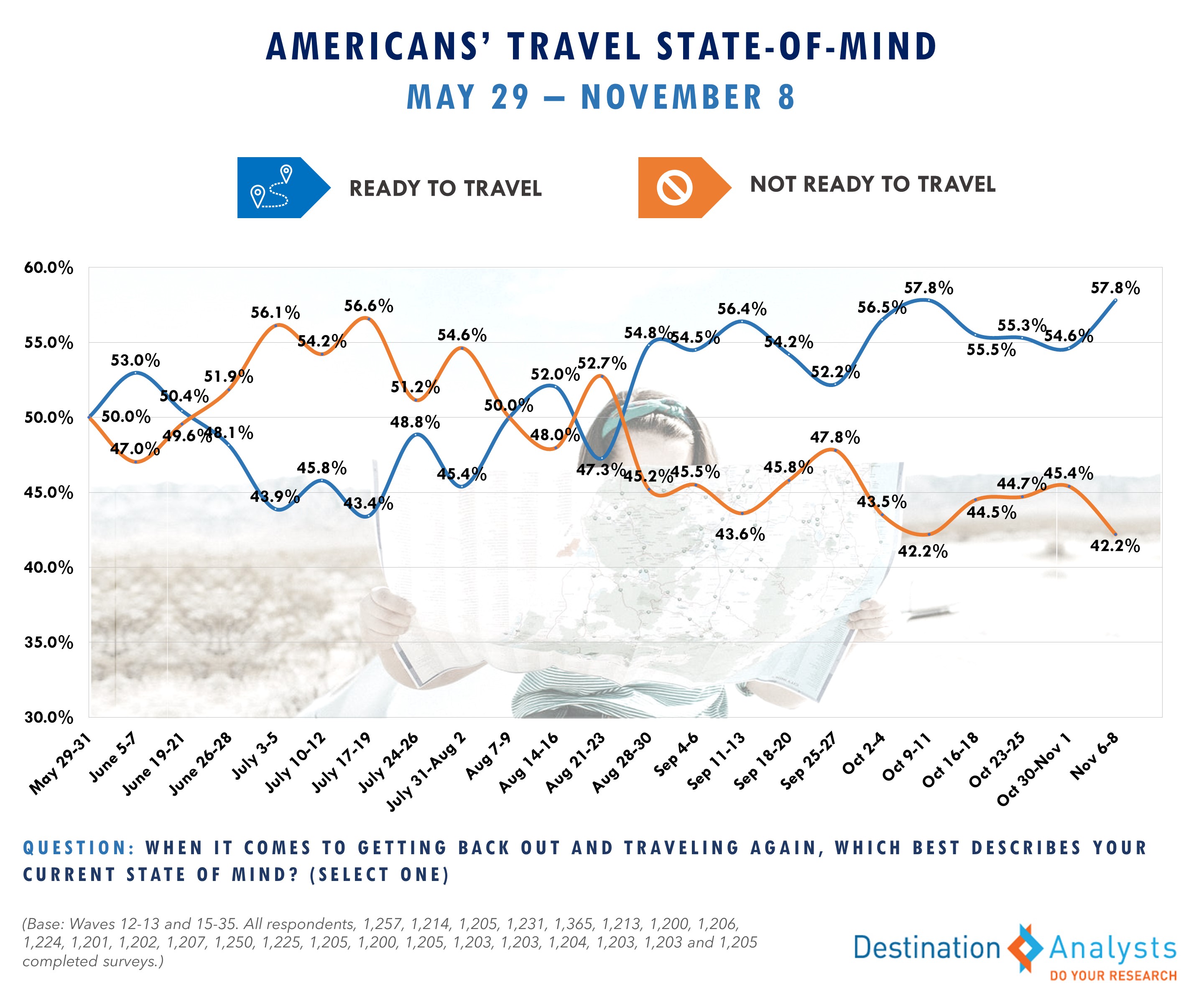

- Nearly 6-in-10 Americans have returned to a readiness state of mind around travel.

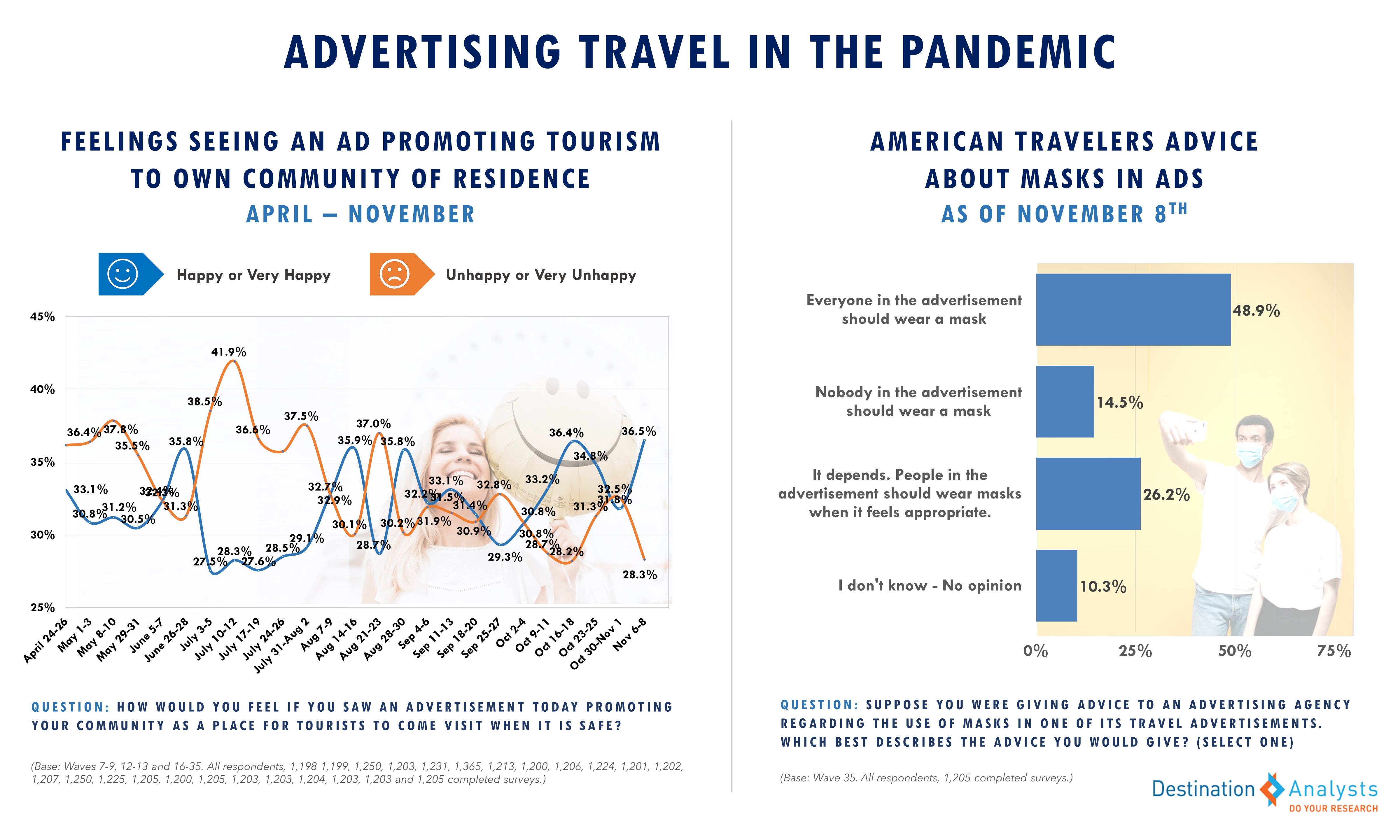

- A pandemic-high 36.5% of American travelers say they would be happy—or very happy—to see an ad promoting tourism to the place where they live. However, the desire to see people wearing masks in all travel ads has remained strong.

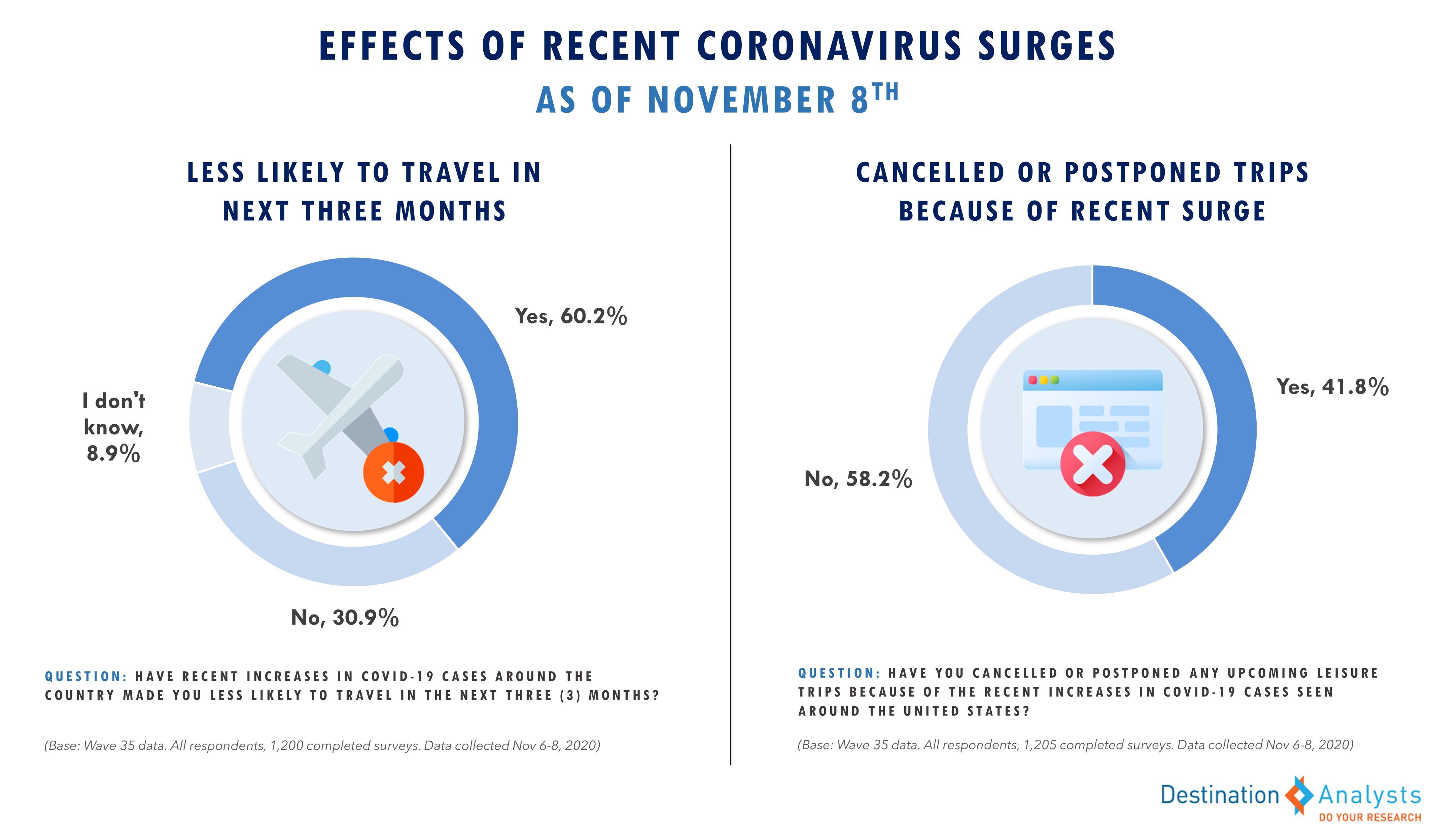

- The current surge is not without its impact: 60.2% say that the recent increases in COVID-19 cases around the country have made them less likely to travel in the next three months and 41.8% report that they have cancelled or postponed an upcoming leisure trip because of the worsening of the pandemic in the U.S.

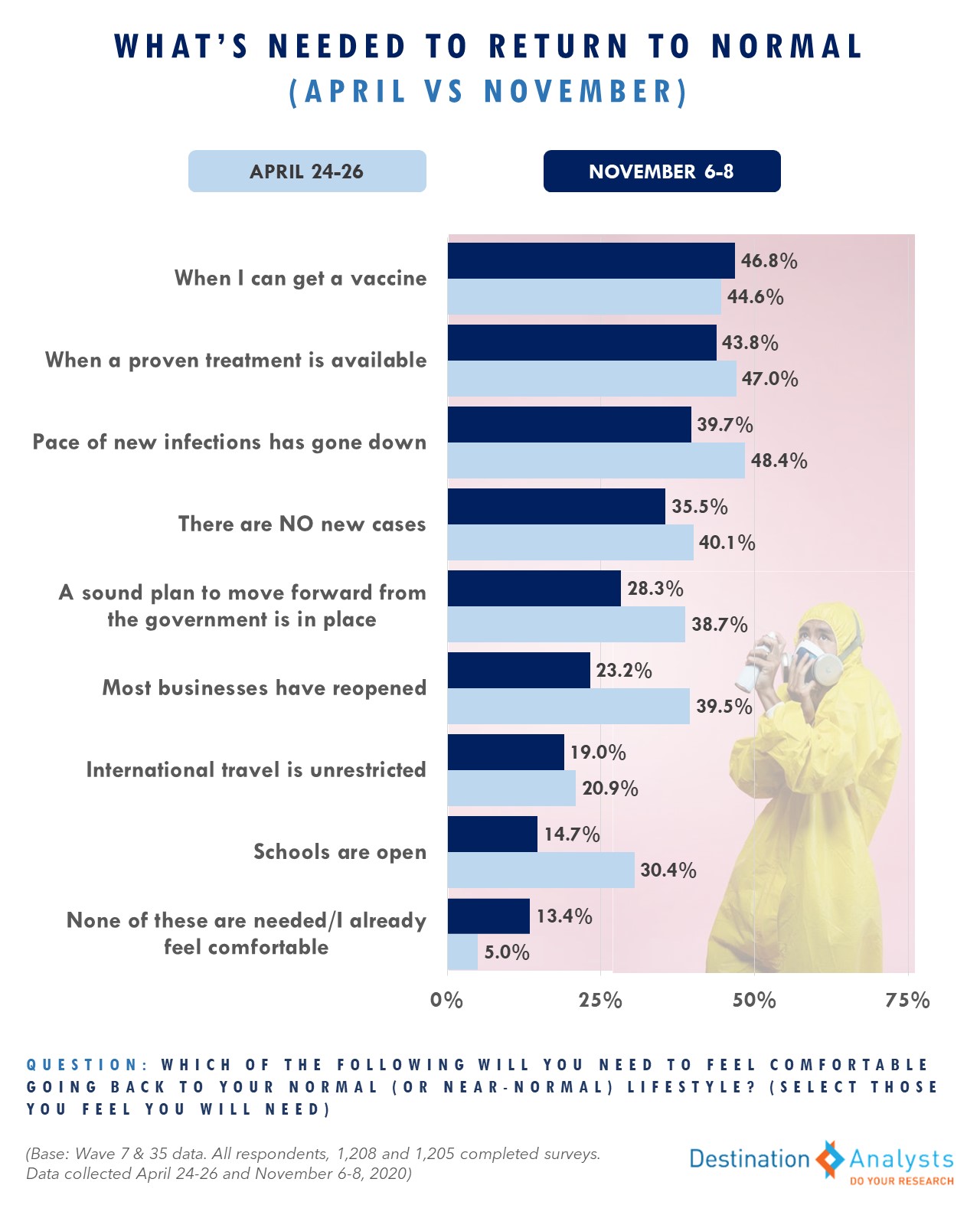

- Nevertheless, eight months into the pandemic, Americans do exhibit signs of adapting towards regaining normalcy, needing fewer circumstances to feel comfortable returning to their pre-COVID lifestyle.

- Since September, there has been a 5% decrease in the percent that affirm they would take a COVID-19 vaccine that is developed this year or in early 2021 (39.2%), but the length of time Americans say they prefer to wait to take an approved vaccine has lessened.

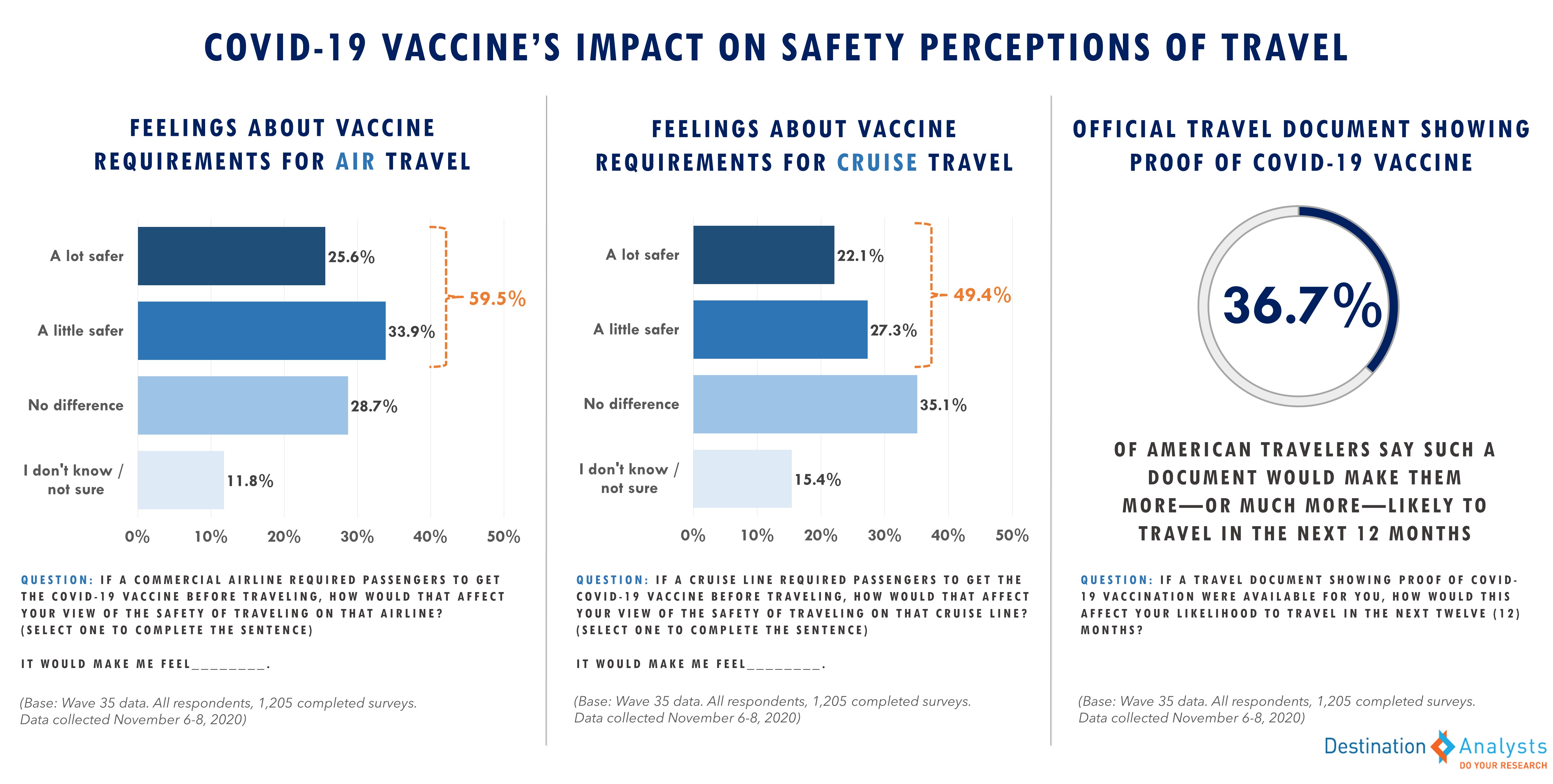

- If a COVID-19 vaccine was required before traveling, nearly 60% of American travelers said this would make air travel feel safer and nearly 50% said they this would make cruise travel feel safer. In addition, 36.7% of American travelers say the availability of an official document confirming COVID-19 inoculation would make them more—or much more—likely to travel in the next 12 months.

- When asked about the COVID-related protocols they feel are absolutely necessary to feel comfortable attending special events and festivals, desires are similar to retail businesses, in that they want masking, frequent cleaning and limited crowd sizes to ensure social distancing is possible.

- Don’t forget to register to attend a full update of these findings on Tuesday, November 10th at 11:00am ET.

Americans spent much of the last week awaiting election results and watching COVID-19 continue to set new records in our country–hitting the highest daily number of new cases since the pandemic began. While Americans overwhelmingly remain in an elevated state of anxiety, they may be feeling slightly more hopeful. This week, somewhat fewer feel the coronavirus situation is going to get worse in the next month (58.7% down from 60.9%). After worsening for two weeks, the perceptions of travel activities as safe rebounded back to pandemic-period low levels. Excitement for a potential getaway and openness to travel inspiration improved, as did the ability of discounts and price cuts to motivate travel. Less Americans agree that they wouldn’t be able to fully enjoy it if they traveled right now, dropping 5% in the last two weeks (60.1% to 55.1%). Thus nearly 6-in-10 Americans have returned to a readiness state of mind around travel.

With their desire for travel inspiration returning and their comfort going out for leisure in their own communities growing, now 36.5% of American travelers say they would be happy—or very happy—to see an ad promoting tourism to the place where they live. This exceeds the percent that would be unhappy by over 8% and represents a pandemic-period record high. However, given the vast majority of Americans who have high degrees of concern about personally or friends/family contracting coronavirus, their desire to see people wearing masks in travel ads has remained strong. When asked how they would advise advertising agencies about the use of masks in travel advertisements, nearly half said everyone in the ad should wear a mask. Another quarter says it depends, but people should be wearing them when appropriate. Just 14.5% advised that no one should wear masks in travel ads.

Given the pandemic’s heavy influence on travel sentiment and behavior, the current surge is not without its impact. The percent with high degrees of concern about the virus’ impact on their personal finances and the greater economy increased this week. And the surge looks like it has diminished the potential volume of travel that could have occurred. Looking at the percent of Americans who have traveled since the onset of the pandemic in March, it appears that still only around half are traveling. Now 60.2% say that the recent increases in COVID-19 cases around the country have made them less likely to travel in the next three months. Unfortunately, 41.8% report that they have cancelled or postponed an upcoming leisure trip because of the worsening of the pandemic in the U.S.

Nevertheless, eight months into the pandemic, Americans do exhibit signs of adapting towards regaining normalcy. When asked what they need to feel comfortable going back to their normal (or near-normal) lifestyle, notably fewer need a number of circumstances to be in place compared to than in the first phase of the pandemic in April.

However, the one area nearly 47% of Americans have remained steadfast in needing to return to their normal lifestyle is a COVID-19 vaccine–although the percent agreeing they need a vaccine to do any travel has been on the decline for the last four weeks (38.2%). Since September, there has been a 5% decrease in the percent that affirm they would take a vaccine that is developed this year or in early 2021 (39.2%), but the length of time Americans say they prefer to wait to take an approved vaccine has lessened, so that 30% feel they now need less than three months. When vaccines become available, they continue to be very promising in bringing a segment of travelers back and increasing travel overall. If a COVID-19 vaccine was required before traveling, nearly 60% of American travelers said this would make air travel feel safer and nearly 50% said they this would make cruise travel feel safer. In addition, 36.7% of American travelers say the availability of an official document confirming COVID-19 inoculation would make them more—or much more—likely to travel in the next 12 months.

Prior to the pandemic, nearly one-third of American travelers took trips specifically to attend a special event or festival, and these travelers are likely hoping for the return/recovery of these live events. When asked about the COVID-related protocols they feel are absolutely necessary to feel comfortable attending such events, desires are similar to retail businesses, in that they want masking, frequent cleaning and limited crowd sizes to ensure social distancing is possible.